|

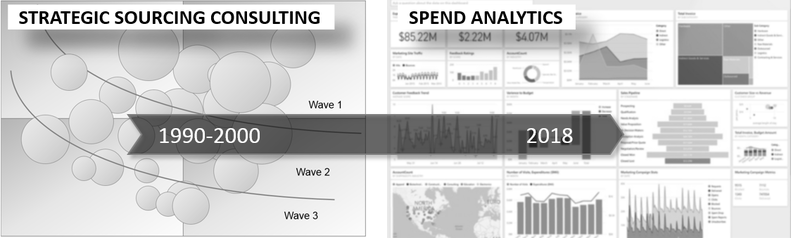

When I emerged freshly minted from B-school in the mid-nineties and inserted myself into the flow of warm bodies entering consulting the hot practice area every firm was building was strategic sourcing. Nail your case interview and before you could say "center-led procurement" you'd be pulling down close to six figures driving pivot tables and powerpointing sourcing wave strategies. The attractiveness of sourcing consulting back then was that it represented a way to create a consulting services money engine by billing out highly educated resources to put on steroids a very well defined existing business process - purchasing - that was already being done by existing company employees. Driven into orbit by the "Power of Procurement" large firms and indeed many smaller players enjoyed over a decade of profit taking based on a solid assess-propose-implement methodology backed by a created savings business case model that employed a B-school take on created value even if a little light on dollars in pocket. To give credit where it's due there were a number of laudable accomplishments during this period in areas such as fact-based negotiation and procurement-focused change management. But anyone adopting a truly objective view would have to admit that strategic sourcing consulting in its heyday was optimized around a repeatable one-time service delivery model rather than the creation of a sustainable capability for the customer. The main reason sourcing consulting growth eventually plateaued was that many of the former consultants who led the charge in the nineties became VPs of Procurement who now saw the service they used to deliver as a laser-focused gap filler rather than a turnkey solution. Sourcing consulting is by no means dead but is more pragmatically applied. More useful in fact. Is spend analytics the 21st century version of the 90s era strategic sourcing money engine for consulting firms? Working with clients over the last 2-3 years I began to notice echoes of the nineties sourcing consulting phenomenon in spend analysis, or shall we say spend analytics as it more commonly referred to today. Rarely can a week go by without a blog post or white paper addressing the transformation and extension of spend analytics beyond just the building of spend cubes to end-to-end procurement and supply market intelligence. Enterprises, we are told, must engage the power of AI to fully leverage the explosively increased quantity of decision making information available to them. The smallest surprise of all is that a legion of providers are at the ready to deliver the services that are surely needed to tap this newly available procurement power source. The question companies should ask however is whether these services represent a timely response to customer needs or whether they are primarily a provider model designed to opportunistically tap a market. They could and probably should be both of course, but it’s the relative weight of each that’s important. In November 2017 I met with a focus group of 18 Southern California procurement executives to capture input for a presentation I was preparing on the subject of spend analytics in the mid-market. The companies represented ranged in annual revenue from $250M to $900M and operated in industries that included healthcare, industrial manufacturing, financial services, retail and telecommunications. In addition to the numerous learnings and insights shared by individual executives based on their company experiences, three findings surfaced during the day that were notable by the fact that they were relevant to the majority of the companies present:

On the face of it these findings seemed to support my earlier anecdotal observations of the newer provider solutions not being in tune with customer requirements, at least in the mid-market. Following the meeting I decided to investigate whether the focus group findings were representative of the mid-market as a whole and whether, in general, conclusions could be drawn that were defendable statistically. To this end I worked with a third-party survey company TTL Inc. during January and February 2018 to issue an online survey to the executive responsible for procurement at 6,717 US companies with annual revenues between $100M and $1B across multiple industry sectors.

In part 2 of this post I will present and talk about the findings of this survey and the implications of these findings for companies and providers alike.

1 Comment

Chris Berndeen

5/30/2018 10:20:51 am

Many larger companies still have difficulty with classification today. Automation will only get you so far if AP are coding incorrectly and vendor masters are full of dupes. What are the spend analysis consulting services you mention? For the cleansing and classification, or opportunity assessment?

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

1 Procurement Place

Non-spin commentary on the world of procurement, supported every now and then by the occasional piece of factual information. Mark Usher

Mark is Founder and CEO of SpendWorx LLC, a provider of spend analytics services. Prior to SpendWorx Mark co-founded Treya Partners, a boutique procurement consultancy. Earlier in his career Mark held various positions at Accenture, GE Aviation and Rolls-Royce.

Archives

December 2022

|

RSS Feed

RSS Feed