|

One sector of the procurement services market that has seen much change recently is that of horizontal Group Purchasing Organizations (GPOs). Unlike their vertical GPO and buying cooperative cousins that focus on specific industries, horizontal GPOs offer leveraged contracts for indirect cross-industry spend categories. From being an under the radar sourcing strategy a decade ago horizontal GPOs are making it on to the invite list for more and more indirect spend RFPs. They have also become targets for acquisition. One case in point is OMNIA Partners who through the 2017 acquisitions of Corporate United, Prime Advantage and US Communities created a buying giant that, according to OMNIA's website, boasts a total buy of $10 billion across over 30 industries. Several private equity firms have also been active, either buying GPOs or forming them internally to leverage spend acoss their portfolio companies. When horizontal GPOs first gained traction a decade ago they were primarily targeted at mid-market companies using the "we have discounts you couldn't negotiate on your own" message. What do the recent changes in the horizontal GPO sector mean for those mid-market companies today? To help answer this question I spoke recently with Lisa Wylde, a purchasing manager for Valco US, a mid-market manufacturer of custom fasteners and hardware. In her time at Valco Lisa has utilized regional and vertical cooperatives as well as horizontal GPOs to secure discounts for a broad range of indirect spend categories including facility MRO supplies, industrial gases, uniforms, cleaning chemicals, copiers, office supplies and small parcel shipping. I think you'll agree Lisa's experience throws an interesting perspective not just on how recent events have affected the horizontal GPO's value proposition for the mid-market but also on how that value proposition was perceived originally. Mark Usher: When did you start using pre-negotiated contracts as part of your procurement strategy and what type of providers and contracts were you using at first? Lisa Wylde: When I started at Valco in 2009 we were already using a set of contracts from a regional cooperative of companies in the tri-state area. Valco paid a modest annual subscription to get access to contracts that covered areas like safety supplies, janitorial, personal protective equipment (PPE), small tools, hardware, fasteners, electrical, HVAC and plumbing. The same cooperative also had contracts for office supplies and computers but the pricing wasn't very competitive so we negotiated those on our own. Mark Usher: What type of discounts did you get on the regional cooperative contract and were you able to compare these discounts to the market to see how competitive they were? Lisa Wylde: We were selective in the contracts we used from the cooperative and only used ones we knew had aggressive discounts. Discounts were quoted from a list but the cooperative's contract also listed OEM part numbers. At least once a quarter we'd check price against other regional and the national distributors to make sure the contract discounts stayed competitive. A key point here is that the cooperative agreements were negotiated by someone at one of the regional companies. They had a vested interest in making sure the pricing was good since they were eating their pudding so to speak. Mark Usher: What was your first experience of horizontal GPOs? Lisa Wylde: In 2014 we put an RFP on the street for facility and industrial MRO. We weren't unhappy with our cooperative pricing but at that time but we saw the activity in the MRO vendor market, including horizontal GPOs, and figured we had just enough volume to interest the larger national distributors or GPOs. We left our regional cooperative in the mix and decided to take the approach of wait and see. We were prepared to move all our business to a national player if the pricing and service levels were right but also ready to parcel it out if individual vendors were more competitive for specific sub-categories. We ended up doing the latter by retaining our regional cooperative agreement only for janitorial, safety and electrical supplies (about 30% of the total baseline) with the remaining sub-categories split between a full-line national distributor (about 50%) and a horizontal GPO (about 20%). Mark Usher: What was your criteria for the award and did you calculate a hard cost savings number for the new contracts? Lisa Wylde: We decided to make our delivery requirements and service levels mandatory - essentially pass/fail - then assign 70% weighting to cost and 30% to supplier financial stability. Our feeling was these are non-strategic categories where we are looking for measurable savings and efficiency. Having said that if a supplier can't meet our critical spare lead time then savings are moot. Our split of the business by the various sub-categories was based purely on who provided better pricing. The national distributor certainly won big there but we were quite surprised by the horizontal GPO which was not competitive for many sub-categories and only had lower pricing for fasteners and hardware. Mark Usher: Did you have volume commitments in the contracts? Lisa Wylde: Short answer, no. However in the RFP we provided very detailed historical usage data and stated that future projected usage was expected to be similar within given plus or minus percentages for the different subcategories. We wanted best pricing upfront but did give vendors the option to include quarterly rebates based on trailing quarter volumes. We took these rebates - if offered in the vendor response - into account during the evaluation process by calculating total costs for each vendor under different scenarios of future usage. The regional cooperative and the national distributor provided rebate schedules, the horizontal GPO did not. Mark Usher: So how have things gone since you implemented the new contracts and what are some of your learnings, especially about the horizontal GPO? Lisa Wylde: Overall implementation was smooth. Luckily my commodity manager who led the implementation is very experienced in the roll-out, communications and training areas that can kill you in a contract implementation. So 6 months in we were 80-90% compliant and by a year maverick spend was pretty much zero. We're doing a reasonable job of price compliance although my biggest wish there is that we could change it from an after-the-event audit activity governed by my resources to more of a real-time activity where we know the price is right at the order. The other learning for us is understanding vendor capabilities, particularly for an unfamiliar service model. The regional cooperative - essentially regional vendors - we understand 100%. In fact we both know each other's business as well as the other and very little ever gets lost in translation or negotiation. The full line distributor is straightforward too, he works the volume play. The horizontal GPO I'm definitely still learning though. They can look like a full-line in some categories but then in others they are not competitive. During the RFP process they were very transparent about the fact they extracted fees from their preferred vendors and in some cases where the pricing was close with our regional cooperative I'm sure that fee was what lost them the business for that sub-category. The other reason I am a little wary of the horizontal GPO in terms of a broad match with our needs is that I suspect that their preferred end game may be services rather than product. Their account manager is often positioning value-added services to me like analytics and sourcing support. That's probably in demand from the larger companies but for us we don't have the cost base to warrant what I see as an outsourcing model. Having said that their pricing for our traditional MRO needs worked for 20% of our spend so I want to keep learning their model and their value going forward. Mark Usher: Thank you Lisa for sharing your experience and your insights!

1 Comment

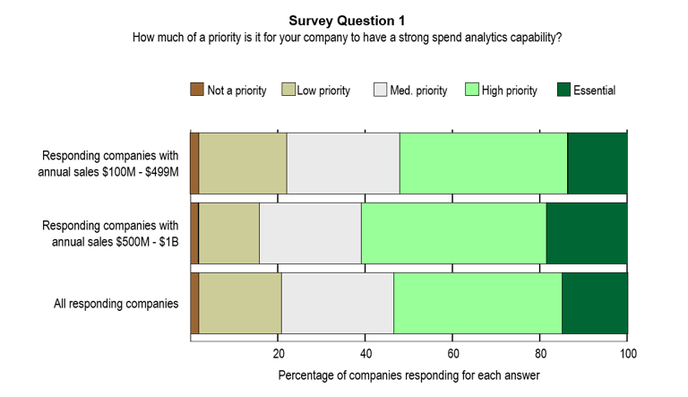

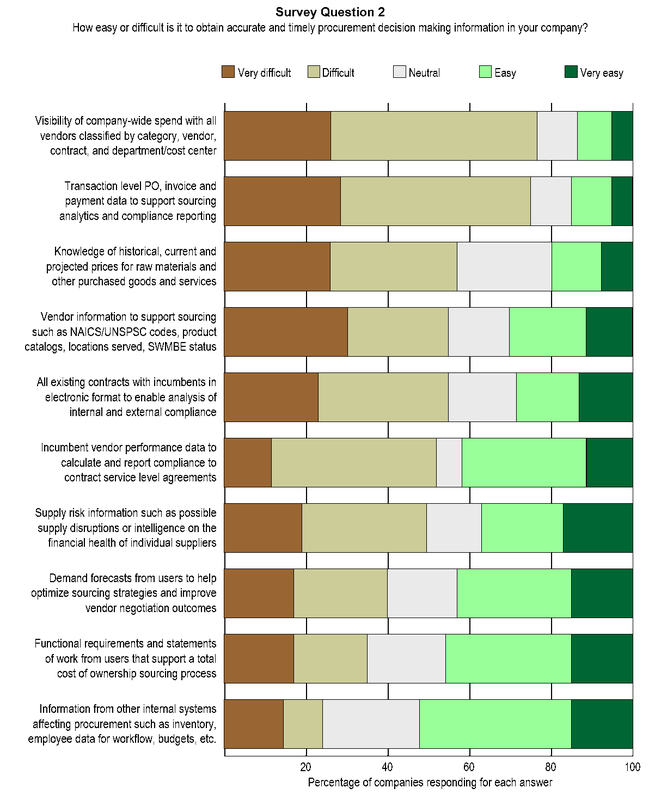

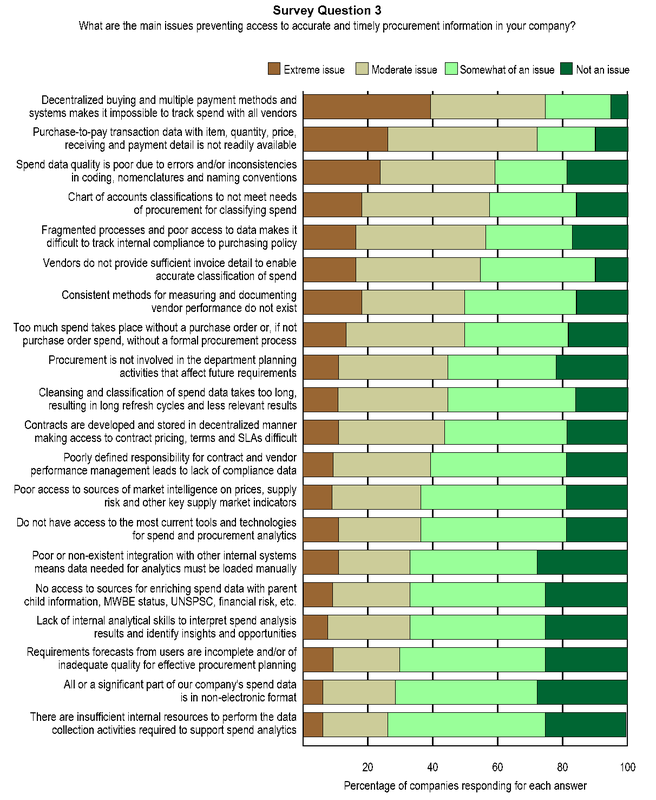

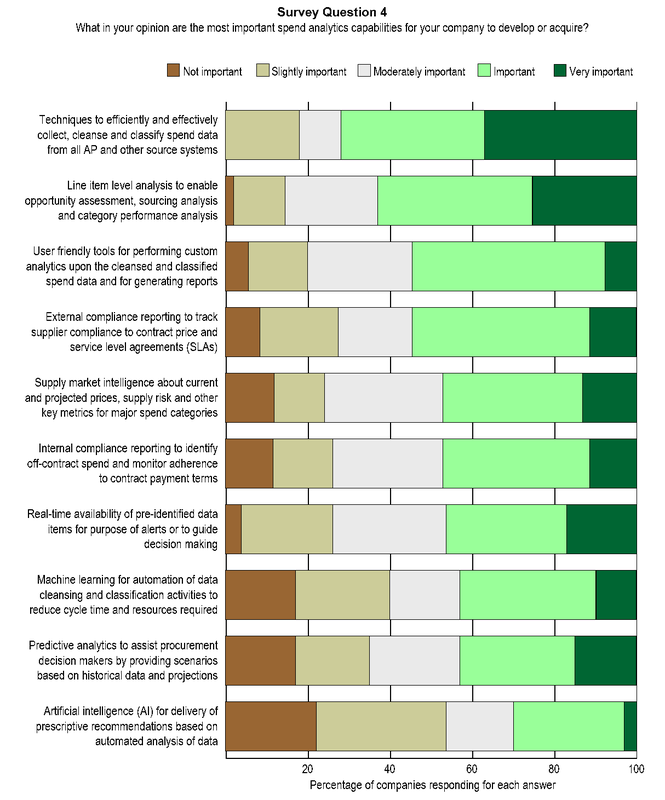

In the first part of my post Is Spend Analytics the Next Consulting Services Money Engine? I discussed my personal opinions and observations about how the current market for spend analytics services seems similar in some ways to strategic sourcing consulting in the 1990s. I also revealed the results of a focus group meeting of 18 small to medium sized companies I hosted in November 2017 that strongly suggested providers might not have a full and accurate understanding of the primary issues and concerns of the mid-market when it comes to spend analytics. In this second part of the post I will present the key findings of a comprehensive survey of the mid-market I conducted earlier this year, the objective of which was to investigate whether the findings of the 2017 focus group were truly representative of the mid-market on a statistically defendable basis. The complete survey report titled Spend Analytics in the Mid Market: The Real Story can be downloaded with a registration on the SpendWorx website but a summary of the survey approach, results and conclusions are provided below. Survey Approach During January and February 2018, I worked with a third party survey company TTL Inc. to issue online surveys to the executives responsible for procurement at 6,717 US companies in all states with annual revenues between $100M and $1B across multiple industry sectors. Usable responses were obtained from the head procurement executives at 419 companies. This equates to a response rate of 6.2%, which is in line with typical response rates for comparable surveys. The three largest industry sectors represented by the respondents were manufacturing (109 companies, or 26%), wholesale (88 companies, or 21%) and retail (71 companies, or 17%). In terms of annual revenues 45% of the companies fall in the range $250M - $499M, 35% in the range $100M - $249M, 13% in the range $250M - $749M and 7% in the range $750M - $1B. Survey Results Survey Question 1: How much of a priority is it for your company to have a strong spend analytics capability? Of the 419 responding procurement executives, some 222 (53%) stated that spend analytics was either a high or essential priority in their companies (see Figure 1 below). Of the 84 executives working for companies with annual revenues of $500M-$1B this percentage increased to 61% (51 companies) confirming the widely held view that larger companies with higher procurement expenditures will generally implement tighter control over their spend. For the 335 companies with annual revenues of $100M-$499M, the percentage of them for which spend analytics was a high or essential priority stayed respectably high at 51%. Figure 1 Survey Question 2 - How easy or difficult is it to obtain accurate and timely procurement decision making information in your company? Here the survey respondents were asked to assess ten types of procurement-related information in terms of the ease or difficulty of obtaining the information in an accurate and timely form in their companies. The results in Figure 2 below show that the three types of information assessed as being most difficult to obtain in accurate and timely form are company-wide cleansed and classified spend, transaction level procure-to-pay data, and market price information. Procurement-related information presenting less of a challenge is internal systems information required to support procurement processes (e.g. financials, inventory, HR. etc.) functional requirements for sourcing, and user demand forecasts. Figure 2 Survey Question 3 - What are the main issues preventing access to accurate and timely procurement information in your company? In this question the survey respondents were provided with a list of 20 commonly faced procurement data issues and asked to indicate the degree to which each was an issue in their own company. It can be seen from the results in Figure 3 below that the issues identified as causing the most problems are strongly correlated with the types of decision making information that are most difficult to obtain in accurate and timely form from Figure 2 above. For example, the top 3 issues in Figure 3 (decentralized buying, lack of detailed transaction data and poor data quality) all directly contribute to the fact that accurate and timely company-wide cleansed and classified spend is the most difficult type of information for procurement decision makers to obtain in Figure 2. Other issues identified as either extreme or moderate by more than 50% of the executives included non-useful chart of account descriptions, lack of detail on vendor invoices, lack of a consistent vendor performance measurement methodology, and too much spend without a purchase order. Issues identified by the responding executives as less of a concern towards the bottom of Figure 3 included insufficient internal resources for data collection, spend data in non-electronic format, poor or incomplete requirements forecasts from users, and lack of internal analytical skills to identify insights and opportunities from spend data. Figure 3 Survey Question 4 - What in your opinion are the most important spend analytics capabilities for your company to develop or acquire? In this final question the responding mid-market procurement executives were provided with a list of spend analytics-related capabilities and asked to identify which in their opinion were the most important capabilities for their company to develop or acquire bearing in mind their company’s unique procurement and data environment. From Figure 4 below it can be seen that over 80% of the procurement executives identified techniques to efficiently and effectively cleanse and classify spend data from all AP and other source systems as either very important or important. Over 50% of respondents further identified line item analysis, user friendly analytics and reporting tools (for working on the already cleansed and classified data) and supplier compliance as capabilities that were also either very important or important for their organizations. Some of the capabilities regarded as lower in importance (at least at this moment in time) included artificial intelligence (AI), predictive analytics and machine learning. Figure 4 Conclusions The survey of mid-market procurement executives produced findings consistent with the November 2017 focus group in a number of areas, namely: Continuing challenges with basic spend analysis issues. The survey confirmed the finding of the focus group related to continuing issues with procurement data. Based on the survey results, mid-market companies still experience significant difficulties in achieving enterprise-wide spend visibility due to challenges in extracting, cleansing and classifying spend data. Advanced spend analytics technologies not yet on radar. A clear finding from the survey was that mid-market procurement executives are more concerned with ‘block and tackle’ issues like cleansing, classification and getting a basic analysis and reporting capability up and running than they are about AI, cognitive procurement or machine learning. The implication is that until the mid-market has spend visibility mastered, the penetration of advanced analytics into the sector will be limited. Smaller companies are on board with the power of procurement. For over 50% of responding companies between $100M-$500M annual revenues to identify spend analytics as an essential or high priority is a clear indicator of how far smaller mid-market enterprises have come in embracing the value of a proactive approach to procurement. Small companies that move first to implement strong spend analytics capabilities stand to gain significant and sustainable cost and profitability advantages over their similarly sized competitors. Lessons for solution providers. Another theme of the November 2017 focus group corroborated by the survey was the perception that technology providers did not understand some of the unique requirements of mid-market companies compared to Fortune 500 companies when it came to spend analytics. The surprisingly low importance placed on the newer technologies in the survey should be a warning to solution providers that the majority of mid-market companies still need help finding their way out of the spend visibility forest. Only then will they be able to look ahead and appreciate the value that the new technologies will bring. The complete survey report Spend Analytics in the Mid Market: The Real Story can be downloaded with a registration on the SpendWorx website here.

Guest Post by Jeffrey Frost, VP Supply Management, Strachan Products Inc. As a contrast to me droning on, I'm excited to welcome Jeff Frost to 1 Procurement Place. Jeff is the VP of Supply Management for Strachan Products, a manufacturer of parts and components for automotive and aerospace OEMs. Strachan Products is also a founder member of Spend Engine, a collaborative procurement community which in full disclosure is owned by my company SpendWorx LLC. It is the subject of procurement communities that Jeff writes about in his fascinating post below. Welcome Jeff! When Mark Usher first approached me last year about the idea of participating in a procurement community I had two immediate thoughts as to what he might be talking about. That it might involve camping out at weekends exchanging purchasing war stories I quickly dismissed. More likely was some type of Group Purchasing Organization (GPO) pooling G&A purchases like office supplies or PCs across member companies. GPOs are certainly something Strachan has looked at in the past but on the times we have evaluated them their pricing has only been marginally better than what we could negotiate on our own. In addition they have always seemed to me to represent one rather tactical component of what could be a far more strategic approach to collaboration. I was very pleased when it turned out that Mark was talking about something a lot closer to this more strategic model with his company's collaborative procurement community. Take the clock forward a few months and I'm only too happy to describe some of the initial benefits and learning that have arisen from our involvement in Spend Engine. First, though I say it myself, our company does most of its buying pretty well. We also don't sweat the small stuff. When we acquired a former federally funded entity in 2009 to bolster our R&D capability we also "acquired" a small team of outstandingly talented procurement professionals who knew indirect sourcing & contracting inside and out. Within six months they had over 80% of our non-payroll G&A expenditure nailed down under aggressively priced blanket contracts with all kinds of contract clauses, market-linked indexes and SLA guarantees to ensure we were always getting the best deal without having to do the three bid-and-a-buy game that steals procurement resources from higher value work. Once indirect was put to bed we turned our focus to where this higher value resided, namely in our direct materials spend. When it comes to our direct spend it's extremely custom and - you would think - as poor a candidate for any type of collaborative procurement as it comes. But that's only if you think of collaborative procurement in traditional GPO-type terms as a group of buying companies pooling volumes to secure leverage-based unit pricing with vendors. That's not what Spend Engine is. Mark Usher can do a far better job of explaining the details of Spend Engine but for Strachan it's allowed us to form relationships with companies that don't necessarily buy the same stuff but that buy stuff with similarly constrained specifications and from supply markets with similar dynamics. Take precious metals for example. We buy significant quantities of platinum to manufacture some of our products. Two other companies in the Spend Engine consortium also buy precious metals, but not platinum. Although we will never leverage spend together in the GPO sense there are numerous common precious metals-sourcing best practices we can mutually support each other in the development of such as management of price volatility, addressing global supply risk, ensuring ethical practices of supply sources, and many others. After just a few months of involvement in the community I can say with certainty that the core business-impacting value captured from this collaboration has exceeded by many times the equivalent value that would be created over the same period from, say, an MRO consortium contract. That's not to say we wouldn't get value from such a contract - one day we might - but the point is that today it is magnification of knowledge that moves the dial for us, not dollar spend. My closing point for procurement organizations thinking of using GPOs or similar approaches is to look beyond the benefits of leverage-based unit price reduction to the higher value that is possible from collaboration with other companies on strategies related to your core business. From experience I can say that for Strachan Products the investment of time in a collaborative procurement community has certainly been worth it and is something that we plan to continue.

|

1 Procurement Place

Non-spin commentary on the world of procurement, supported every now and then by the occasional piece of factual information. Mark Usher

Mark is Founder and CEO of SpendWorx LLC, a provider of spend analytics services. Prior to SpendWorx Mark co-founded Treya Partners, a boutique procurement consultancy. Earlier in his career Mark held various positions at Accenture, GE Aviation and Rolls-Royce.

Archives

December 2022

|

RSS Feed

RSS Feed